Links to Remember

Financing Study Abroad

In this section, you will learn how to help cover the costs of study abroad in Australia. With appropriate planning, most students that can afford to study at a U.S. college or university, can afford to study abroad in Australia. It is important to take into account all program costs to ensure you have sufficient funds for a healthy and safe experience in Australia.

In most cases, a student's financial aid package should cover most, if not all, of the costs of certain study abroad programs. Usually, study abroad programs affiliated with your U.S. home campus are more likely to be covered by financial aid. If you don't have financial aid, there are also many scholarships and fellowships available; you just have to know where to look for them. Grants and loans are yet another way to help cut costs. The following is a list of the different types of financial aid that a student may need to finance their program:

- Loans and Financial Aid: If you receive financial aid, study abroad in Australia may be partially or fully covered by the terms of your financial aid package. If the study abroad program you have chosen is directly associated with your U.S. home campus, you may have a better chance of having your financial aid money cover your program costs in Australia. However, you can't assume that financial aid will apply; even if it does, there may be limits as to what it covers. Inquire about the terms of your financial aid package at your college or university's financial aid office. You may also be eligible for a student loan, or an additional loan, if you receive federal work–study as part of your financial aid packet. Before asking for a bank loan, ask a financial aid adviser on your campus.

- Scholarships, Fellowships and Grants: With advance planning, you may be able to obtain scholarship or grant money from your U.S. home university or even from the institution in Australia where you will study. There are many academic awards and fellowships available for students with an interest in study abroad or other international experiences. To find scholarship and fellowship opportunities, visit your college or university's financial aid office, search on–line, or consider purchasing one of the many books available on the subject. Many academic departments also offer student research grants for research completed abroad; most often, the fields of anthropology, geology, and medicine offer research grants.

- Other Sources of Money: Even though it may be hard to juggle a full load of classes and a job, working is a great way to raise money for study abroad. Although working on–campus doesn't usually get you the highest salary possible, campus jobs do help your cash flow. Since your goal is to earn fast cash, you don't necessarily need to look for a job oriented around your future career. While career–oriented jobs can be terrific learning and networking opportunities, non–career jobs may have more flexible hours allowing you to work between classes. Also, try making appeals to your local community, religious and academic organizations. These groups may set aside funding, or take up special collections, for students. If you or your family happen to belong to any community or religious organizations, those groups may be more apt to sponsor you because they know you; these groups often see you as a representative or role model and may even ask you to speak at their meetings when you return from studying abroad. If your study abroad in Australia involves volunteer work or charitable activities, some organizations may also be more willing to support your efforts.

1. Calculating Living Expenses

Cost of Living

Cost of living varies from country to country, with currency fluctuations, and according to your personal budget. You are probably used to a certain standard and cost of living in the United States, and you probably budget your income in order to maintain (or better) the standard and costs to which you have become accustomed. You can calculate the difference in cost of living between the United States and Australia by using an on–line international cost of living converter. Enter the U.S. city in which you live and your current salary. Then, enter the city in Australia where you will study. The converter calculates how much you will need to earn in order to live in Australia as you do in the United States. This rough estimate can provide you with a goal amount of money you will need to raise/save before going abroad: International Cost of Living Salary Converter

Exchange Rates

Some students create an entire, detailed budget and financial plan for their time in Australia only to discover that exchange rates fluctuate and economies can be unstable. When exchange rates were good, you could afford to study in Australia; now that exchange rates are not as good, you may not be able to afford it.

The value of the Australian Dollar against the U.S. Dollar goes up or down significantly and can greatly affect a student's personal budget/financial plan. A solid budget/financial plan worked out months before leaving for Australia just may not work at the time of departure. From the time you first created your budget/financial plan for Australia, exchange rates changed and now your planning has been thrown off. To avoid this, consider making your personal budget/financial plan flexible. Include a high and low total spending amount to account for any possible fluctuations in currency value. Also, frequently check exchange rates to keep a better eye on the Australian and U.S. economies and better predict any drastic fluctuations.

Please see "Exchange Rates" in the Resources section of this handbook for links to currency converters.

Lifestyle

For some students studying in Australia, having enough money is not a worry; they do not need to alter their lifestyle to fit a budget. For others, studying in Australia a may involve more financial planning and changes in lifestyle. If you don't already budget your money at home in the United States, you might want to start doing so when you go to Australia. Budgeting your money doesn't have to be boring or difficult. You can think of easy ways to help yourself remember how much you are spending. Often, foreign currency can seem like "fake" money. It can be difficult to know how much you're spending. This is especially true if you get in the habit of using your credit card for most purchases. A helpful way to convert foreign currency into U.S. dollars is to carry a small pocket calculator with you. You could also learn a few monetary equivalents and tell yourself: "For every Australian Dollar I spend, I'm really spending so many dollars."

Another way to keep track of your spending is to give your purchases a work value. For instance, you could say to yourself: "I will have to work so many hours in order to make enough money to be able to buy this shirt." This way, you begin to see your purchases not only in terms of money, but in terms of the time it will take you at work to earn the money to buy them.

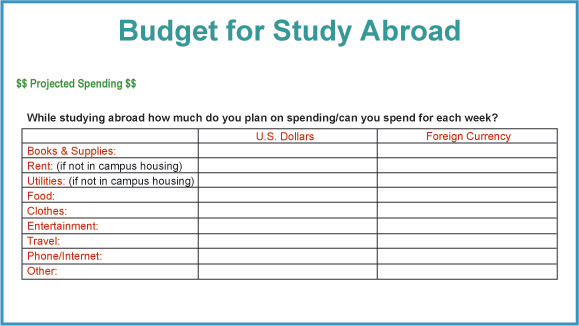

Below is a sample budget ledger you can print out, fill in, and take with you to help you better keep track of your spending in Australia.

2. Relevant Questions

- Have you spoken with an advisor in your school's Financial Aid department?

- Do you know what your financial aid package does and does not cover in terms of study abroad expenses?

- Before taking out a loan, have you looked at all other options (scholarships, grants, jobs, etc.) first?

- For which scholarships, fellowships and grants are you eligible?

- How does the cost of living abroad in the United States compare to the cost of living in your home country?

- Have you started budgeting your income and/or saving money to provide for the program costs and cost of living abroad?

- What categories do you need to create in your budget book/ledger (rent, food, clothes, entertainment expenditures, etc.)?

- Do you try to give all your purchases a "work value" in order to see the time it will take you at work to earn the money to buy them?

- Are there any other ways to cut back on expenses (i.e. coupons, not eating out, etc.)?

- Can you think of any odd jobs that you might be able to do in your neighborhood in order to earn extra money (i.e. washing cars, babysitting, walking dogs, etc.)?

- Have you taken care of all your financial aid and scholarship forms so that you continue to have financial support at your home campus when you return?

3. Checklist

- I have used a cost-of-living calculator to help me figure out the difference in cost between living at home and living in the U.S.

- I know whether the cost of living where I will be studying in the U.S. is higher, lower or the same as the cost of living at home.

- I have begun the process of budgeting my income and/or saving money to provide for the costs of living in the U.S..

- I have a small pocket calculator to carry with me in order to do currency conversions.

- I understand what my purchases are worth; both their monetary value and their time value (how long it takes me to work for them).

- I have created a simple budget book/ledger with categories that will help me better keep track of my spending.

- I know roughly how much my study in the U.S. experience will cost.

- I can comfortably afford to attend the university I have chosen.

- My family and I think that the university I have chosen, and the experience of studying in the U.S., is worth its cost.

- I have thoroughly researched and contacted groups, foundations and organizations that may be able to help me financially.

4. Resources

- Study Abroad Parent Guide Financial Information Financial information geared towards parents, but useful for students as well.

- GlobalScholar.us: Go to Course 1, Module 2, Task 6 "Money Management" about how to save and spend money while overseas.

- AllAbroad.us – Budgeting: Mentors address how to create and follow a budget as well as giving tips for budgeting overseas.

- AllAbroad.us – How to Pay: Mentors answer questions about how to pay for a study abroad experience.

- AllAbroad.us – Study Abroad Scholarships: Scholarships, grants, and fellowships for general study abroad, diverse students, and for non–traditional countries.

- Fast Web This service provides a free customized list of financial aid sources including private sector scholarships, fellowships, grants, and loans.

- GlobalScholar.us: Go to Course 1, Module 1, Task 5 "Funding Your Study Abroad Program" for useful information about saving and how to research financial aid.

- StudyAbroad.com Directory of various financial aid programs and websites for study abroad.

- Study Abroad Student Guide Information about financial aid programs for students studying abroad.

- The Financial Aid Page links to scholarship searches and comprehensive listing of financial aid information.

- The Student Guide Department of Education publishes a guide each year on the eligibility requirements on various federal aid programs.

Student Handbook

Australia

Australia